You’ve worked hard to create a safe and comfortable space for your family, so it’s only natural that you’d want to protect it. But when it comes to home insurance, especially the specifics of roof repair coverage, things can get a bit tricky. You’re not alone if you find yourself scratching your head over policy jargon or struggling to understand exactly what’s covered – and what isn’t.

Don’t worry! This article is designed just for you. We’re going to break down the complexities of home insurance, focusing on roof repairs coverage. We’ll shed light on how claims are approved, common exclusions in policies, and the role your roof’s age and condition play in this puzzle.

If you’ve ever had a claim denied, we’ll help navigate that too. And because we believe knowledge is power, we’ll also share some insider tips on how to maximize your claim and why regular maintenance and inspections matter more than you might think.

Understanding Your Policy: The Basics

Before delving into the nitty-gritty details of your home insurance policy, it’s essential to grasp the basics so you’re not left in the dark when it comes to understanding what’s covered and what isn’t.

Think about your policy as a safety net, ready to catch you when mishaps or disasters strike. It’s like having this solid friend that’s got your back when life throws some curveballs at you – be it fire damage, theft, or yes, roof repairs. But just like any relationship, it’s crucial to understand its boundaries and limitations.

Now imagine yourself cozying up with a cup of coffee on a lazy weekend morning and actually reading through your policy document – sounds boring? Maybe! But knowing those terms and conditions can make a massive difference between having enough coverage for that unexpected roof repair or paying out-of-pocket costs that can drain your savings.

So don’t think of it as an exercise in legalese comprehension; instead, see it as getting to know this reliable friend better who’s there for you during rainy days (quite literally!).

Remember, knowledge is power – especially when navigating the sometimes-complex world of home insurance.

Criteria for Claim Approval

Guess what, not every claim you throw at your insurer will stick – there are certain criteria that might just be the key to getting your claim approved!

Yes, it’s true. Insurance companies aren’t the villains they’re often made out to be – they simply need solid proof before parting with their money.

If your roof has been damaged by a peril covered under your policy like wind or hail, then you’ll likely have a successful claim. But remember, the devil is in the details; if those shingles were already ancient and falling apart before Mother Nature lent her hand, your insurer could argue that it was wear and tear – something typically not covered.

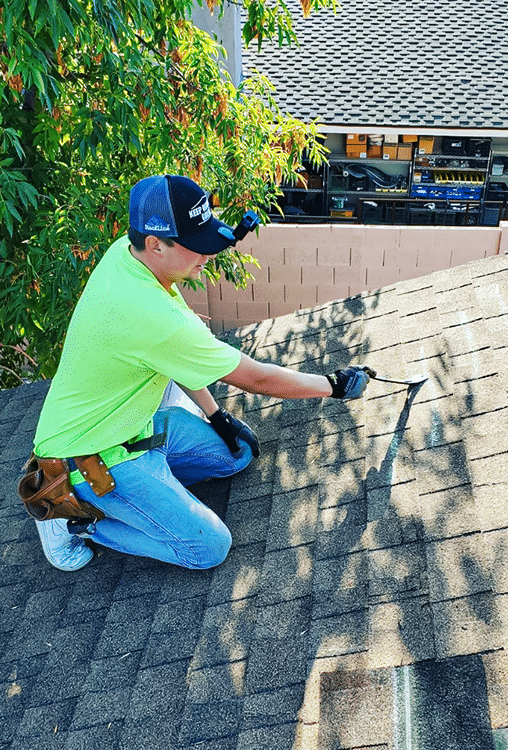

Now here’s where things get interesting: having routine maintenance records can make all the difference when filing for a roof repair claim. So keep track of any professional inspections or repairs done on your roof as these documents can be your best friends in times of need.

And one more thing – don’t hesitate to file a claim just because you think it might get rejected! You’ve got an insurance policy for a reason, after all. It’s there to help you recover from unexpected losses and damages so use it wisely!

Common Exclusions in Policies

Now, let’s not forget about those sneaky exclusions tucked away in your policy. These are the little clauses that could potentially leave you footing the bill for your roof repair, even with insurance.

There might be a clause stating that damage caused by neglect or failure to maintain your property will not be covered. This means if you’ve been ignoring those missing shingles or haven’t cleaned out your gutters in years, and this leads to damage, your claim may be denied.

Another common exclusion is intentional damage – if it’s proven that the damage was done deliberately, don’t expect a payout.

Another important exclusion to keep an eye on involves ‘acts of God.’ It sounds dramatic but what it really refers to are natural disasters like hurricanes, earthquakes, and floods. Many standard policies won’t cover these types of events unless you purchase additional coverage.

And don’t forget wear and tear; insurance isn’t meant to cover inevitable aging and deterioration of your roof. If it’s simply reached its lifespan and needs replacing, chances are this won’t be covered either.

So while you’re sitting under the coziness of your roof tonight, grab that policy document again and read those fine prints carefully – they’re more significant than they seem!

The Role of Roof Age and Condition

Understanding the age and condition of your abode’s top layer can play a crucial role in your insurance claim process. You see, many insurers consider both these factors when determining whether they’ll cover roof repair or replacement costs. The older and more worn-out your roof is, the more likely it is to succumb to weather damage, right? And this risk factor might make you a less appealing prospect for insurers.

It’s not personal; they’re just trying to avoid shelling out big bucks for damages that could have been prevented with routine maintenance.

Now picture yourself curling up on the couch during a thunderstorm, hot drink in hand, confident that even if those relentless raindrops find their way through your old roof, you’ve got it covered – literally! But here’s where things get tricky: If your roof is over 20 years old or been neglected to the point of disrepair, some policies may only pay actual cash value for repairs instead of the full replacement cost.

That means they’ll deduct depreciation based on your roof’s age and condition from what they owe you. So keep an eye on those shingles! Your wallet will thank you later.

Handling Denied Claims

Feeling that gut punch of a denied claim can be incredibly frustrating, especially when you’re already dealing with damage to your cherished abode. It’s the last thing you need, right? You’ve got enough on your plate managing repairs and trying to keep normal life from falling into chaos.

But before you let despair set in, remember this: denials aren’t always final. Insurance companies make mistakes too or sometimes lack the full picture of the situation. If you believe they’ve gotten it wrong, it’s within your rights to challenge their decision.

So how do you go about doing this? First off, don’t lose your cool; maintaining professionalism will get you further than anger ever could. Start by requesting a detailed explanation for the denial – understanding their reasoning is key.

Then gather any additional evidence that supports your case like extra photos or professional opinions from contractors about the roof’s condition and damage caused. Remember communication is key here, so keep all conversations documented and stay persistent but patient.

This isn’t an overnight process but hang in there – every step brings you closer to getting your home back in tip-top shape!

Tips to Maximize Your Claim

Mastering the art of maximizing your claim can be a game-changer, turning a potentially burdensome process into a path towards restoration and peace of mind. Here’s the secret: it all starts with understanding your policy inside out. Don’t wait for disaster to strike before you pull out that dusty document. Take time now to dig in, decode the jargon, and get comfy with what’s covered and what isn’t.

And remember, while your insurance may cover roof damage from storms or fires, it typically doesn’t foot the bill for wear and tear or poor maintenance.

But don’t stop there, my friend! When filing your claim, ensure you’ve documented everything – from the initial damage right down to repairs made. Photos are your best ally here; they offer undeniable proof of damage that even the most skeptical adjuster can’t ignore.

And when getting repair estimates? Don’t just settle for one — get two or three from different contractors so you have solid ground to stand on when negotiating with your insurance company. Remember – this is about getting back on track after an unfortunate event; these steps could help turn a daunting task into an empowering journey towards recovery and serenity.

The Importance of Regular Maintenance and Inspections

Let’s not kid ourselves, keeping up with regular maintenance and inspections can seem like a chore, but it’s absolutely vital in averting the kind of disaster that brings us to our knees.

Your home is more than just four walls and a roof—it’s where your heart resides, where memories are made and dreams are nurtured. And let me tell you something: nothing puts a dampener on those cherished moments like an unexpected roof leak or sudden structural damage.

Regular maintenance isn’t just about preventing mishaps; it’s about preserving peace of mind knowing your sanctuary is as sturdy as your love for it.

Remember, insurers have this peculiar habit—they’re quite fond of homeowners who show they care for their property by taking preventive measures. You see, frequent check-ups and prompt repairs demonstrate responsibility, which could potentially lead to lower insurance premiums—a sweet reward for your diligence!

Moreover, documenting these inspections might come in handy when filing claims since it proves the damage wasn’t due to neglect but rather unfortunate circumstances outside your control.

So go ahead and schedule that roof inspection right away; because investing time in today’s maintenance could save tomorrow’s dream-castle from becoming a nightmare ruin.