You’ve just discovered a leak in your roof, and it’s causing damage to your home. You’re feeling overwhelmed, unsure where to start in the process of making an insurance claim. But don’t worry – we’ve got you covered! This guide is designed with you in mind, providing a step-by-step walkthrough on how to navigate through this often daunting process successfully.

From documenting the extent of the damage to handling potential claim disputes, we’ll be here every step of the way.

Understanding what lies ahead can ease some of that stress; knowing what to expect takes away some uncertainty.

This journey may seem complex, but believe us when we say – you are not alone in this! We will break down each aspect for you so that by the end of our time together, you’ll feel confident about dealing with your insurance company and securing a fair settlement.

Documenting the Damage Extent

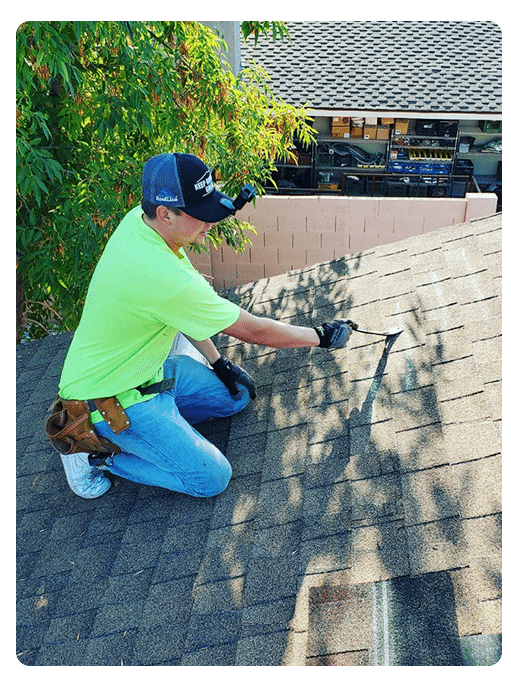

Before you even pick up the phone to call your insurer, it’s crucial that you document the extent of the damage – every crack, every water spot matters. Don’t just glance over and assume they’ve got it covered; they’ll need proof.

This is where your smartphone comes in handy. Snap pictures of everything, from the smallest drip to the largest puddle. You might feel like a forensic scientist at a crime scene but trust me, this evidence will be invaluable when dealing with your insurance claim.

While documenting, don’t forget about those hidden areas too – think ‘out of sight, out of mind’, right? Wrong! Look under carpets and rugs for any water damage signs and check for dampness or mold on walls and ceilings. And while you’re feeling all Sherlock Holmes-ish, make sure you jot down dates and times when leaks occur or worsen as well as weather conditions if they seem relevant – these can all play into how successful your claim is.

Remember, it’s not just about getting things fixed; it’s about creating an intimate understanding between you and your insurer regarding what exactly happened to your home sweet home.

Understanding Your Insurance Policy

Knowing your policy inside and out is critical as it determines what’s covered, how much you’ll be reimbursed, and the procedures for filing a claim. You don’t want to be in the dark about this stuff. So grab a comfy chair, pour yourself a cup of coffee (or maybe something stronger), and get cozy with that insurance policy document. It might not sound like your ideal evening, but understanding exactly what you’re entitled to can save you buckets of cash in the long run.

Now let’s talk specifics: Are roof leaks explicitly mentioned in your policy? If they are, under what circumstances? Some policies cover all ‘sudden and accidental’ damage but exclude anything that results from neglect or wear and tear over time. Also look at your deductible – that’s the amount you’ll have to fork out before insurance steps in to cover the rest. Clearly understand these details before making any hasty decisions or actions! Remember, knowledge is power when it comes to navigating tricky waters like insurance claims.

Contacting Your Insurance Company

Once you’ve armed yourself with a thorough understanding of your policy, it’s time to pick up the phone and have a chat with your insurance provider. Don’t be shy about this step; remember, they’re there to help you navigate this tricky situation. During the call, clearly explain what happened, where the leak is located, and any damage that has occurred. Be sure to ask about your deductible and how it applies in this scenario. Also, inquire if you should take any specific steps or precautions until an adjuster arrives at your home.

Now comes the part where patience is key – jotting down notes during the conversation for future reference. Keep track of whom you spoke to, when the call took place, and all important points discussed. This will serve as proof of contact and might come in handy later on down the line. It’s also a good idea to follow up with an email summarizing everything that was said during your call — just another layer of protection for you in case there are any discrepancies later on. Remember, keeping clear records can make all the difference between a smooth claim process or one filled with hiccups!

Preparing for the Adjuster’s Visit

After your phone call, it’s time to get ready for the adjuster’s visit. This is an important step in getting your roof leak claim approved, so don’t take it lightly.

Start by compiling all necessary documentation – invoices and receipts related to any repairs or replacements you’ve had done, photos of the damage before and after repair attempts, even a log of when the leak started and how often it happens. This evidence isn’t just useful, it’s vital! It helps paint a clear picture for the adjuster about what happened.

Now here comes a significant part: your home’s walk-through. Make sure to guide them through each area affected by the roof leak. Don’t be shy about expressing your concerns or pointing out specific areas of damage that worry you – remember, they’re there to help! But also remember to keep emotions in check; stay calm and composed throughout their visit.

After all, this meeting with the adjuster is not just about assessing damages; it’s also an opportunity for open dialogue between you and your insurance company which can build trust and understanding on both sides.

Negotiating the Settlement

It’s not always easy, but standing your ground and negotiating a fair settlement can bring you great relief and peace of mind. You’ve done the hard work, gathered the evidence, and now it’s time to use that information to your advantage.

Don’t be swayed by initial lowball offers from your insurance company; they’re part of the negotiation process. Show them the estimates from contractors, photos of damage, as well as any other related documents that substantiate your claim. Let them know you’re well prepared and expect a resolution reflecting the damage sustained.

Negotiating with an insurance adjuster might seem intimidating at first — after all, they do this for a living. But remember: so do you! This is about protecting your home—the very roof over your head—and ensuring you have ample resources to repair or replace what’s been lost due to no fault of your own.

Be persistent yet polite in presenting your case. If things aren’t going as planned or if you feel like you’re being short-changed, don’t hesitate to seek professional help such as a public adjuster or attorney who specializes in these types of claims. Just remember: nothing feels better than resolving this stressful situation on terms that respect both your investment and emotional attachment to your beloved home.

Managing the Repair Process

Navigating the repair process can be quite an undertaking, but with careful planning and diligent management, you’ll soon see your home restored to its former glory.

It all begins with choosing the right contractor; someone who knows the job technically and understands your needs intimately. You’ll want to do a little research here – ask friends for recommendations, read online reviews, and most importantly, interview potential contractors.

Don’t hesitate to ask hard questions about their experience dealing with insurance claims and roof repairs. Remember, this is your home we’re talking about – no detail is too small.

Once you’ve chosen a reliable contractor, it’s time to roll up your sleeves and get involved in the nitty-gritty of project management. Make sure that every step of the restoration process aligns perfectly with what was agreed on in your insurance settlement – any deviation could mean extra out-of-pocket expenses for you!

Keep constant communication with both your contractor and insurance adjuster throughout the duration of repairs. This close relationship will ensure everyone remains on the same page while also giving you peace of mind knowing that those tiny leaks are being taken care of perfectly by professionals who are as invested in your home’s wellbeing as you are.

Dealing with Potential Claim Denials or Disputes

Even with meticulous planning and management, you may still encounter a roadblock in the form of claim denials or disputes. It’s like hitting an unexpected bump on a smooth highway; it can be frustrating and confusing. But don’t worry, if your claim gets denied, it doesn’t spell the end of your journey.

In fact, many insurance companies expect you to dispute their initial decision – it’s almost like they’re testing your resolve! Understanding why your claim was denied is the first step towards building a strong case for yourself.

Now, let’s get down to business. If your claim has been denied or disputed, make sure you reread your policy carefully. Yes, even that tiny print at the end where they list all those exceptions! This will help you understand what exactly is covered and what isn’t.

Then gather all necessary documents such as photos of damage before repairs were made or quotes from professionals detailing repair costs and submit them as evidence to support your appeal process. Remember: persistence pays off in this game! Don’t give up easily – keep pushing until they see things from your perspective.

We know it’s not easy but we also know that you have got this!