You’re listening to the pitter-patter of rain against your windows when suddenly, you notice a dark spot on your ceiling. Your heart sinks as you realize that it’s not just an ugly stain – your roof is damaged.

Now, there’s a gnawing question in the back of your mind: should you file an insurance claim for this damage? There are many factors to consider – from understanding the ins and outs of your insurance policy to evaluating the financial implications.

Your home is more than just four walls and a roof; it’s where memories are made, laughter is shared, and dreams come true. It’s no wonder that any damage can seem like an enormous emotional and financial disruption.

This article will walk you through all the pros and cons of filing an insurance claim for roof damage. We’ll help you understand how it might affect future premiums and evaluate alternatives so that ultimately, you can make an informed decision that safeguards your home and its precious inhabitants.

Understanding Insurance Policies

Before you decide to file a claim for roof damage, it’s really important that you get your head around your insurance policy. You may think of it as another tedious task, but trust me, understanding the ins and outs of what your policy covers can save you from headaches in the future.

Don’t just skim through those pages of fine print; instead, dive deep into them. Look for whether or not ‘perils’ like wind or hail are covered. Check if a depreciation value clause could affect how much you receive in compensation.

Now, I know this might sound daunting and slightly overwhelming. However, consider this – isn’t it better to grasp all these details now rather than be caught off guard at the worst possible time? So cozy up with a cup of coffee and spend some quality time with your insurance policy document.

Your future self will thank you when faced with the decision to file a claim for roof damage or not. Remember, knowledge is power!

Evaluating the Extent of the Damage

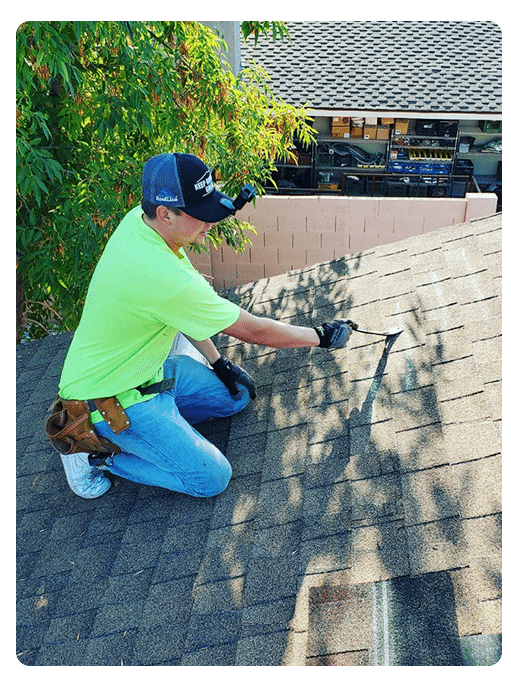

Assessing the severity of your home’s structural issues is paramount, as minor damages might not warrant an insurance claim. You must be your best advocate here, putting on your detective hat and getting down to business.

Look for signs of damage such as missing or broken shingles, leaks inside your home, or dents from hail. If it’s just a few shingles that a storm has blown off, you might be better off repairing it yourself or hiring a professional to do it rather than making an insurance claim – after all, you don’t want your premiums to rise over something relatively small.

Now let’s say the damage is more extensive – we’re talking big leaks causing water damage inside your home – this could be a game-changer. When faced with significant damage like this, filing an insurance claim may well be worthwhile. After all, that’s why you have homeowners’ insurance in the first place!

But remember: even if you decide to go ahead and file a claim, keep those lines of communication open with your insurer and ask plenty of questions along the way. It’s important you understand every step in this process because when it comes down to it – it’s not just about getting things fixed; it’s also about maintaining peace of mind knowing that you’re being taken care of properly.

The Financial Implications of Filing a Claim

Navigating the monetary maze that comes with lodging a homeowners’ insurance claim isn’t always as straightforward as it seems. There’s a whole heap of considerations you’ll need to weigh in on before you decide whether to file that roof damage claim.

Consider your deductible: this is the amount you must pay out of pocket before your insurance kicks in. If the cost of repairing your roof is less than or close to your deductible, then making a claim might not be worth it after all.

Next up, think about potential increases in premiums. Yes, filing a claim can sometimes result in an increase in your insurance rates, which you can’t afford to overlook. You also should take into account the effect of multiple claims on your record – too many could lead insurers to see you as high risk which may lead them to hike up those rates or even drop coverage altogether!

So remember, while getting that damaged roof fixed pronto through an insurance claim seems tempting, make sure you’ve considered all the financial implications first. After all, honey, no one wants their hard-earned money flying off like shingles in a storm!

Impact on Future Insurance Premiums

It’s no secret that your future insurance premiums may take a hit after lodging a claim. Your insurer assesses risk based on your claims history, and they may consider you more prone to risks if you’ve filed for roof damage before. This could increase your premiums, meaning you’ll be paying more for the same coverage in the future.

It’s just like when that old school friend who always borrowed but never returned books suddenly asks for your favourite novel – wouldn’t your trust wane?

However, don’t let this scare you into not filing a claim at all. Yes, there might be a bump in your insurance costs down the line, but isn’t it better than covering all repair costs out-of-pocket?

Imagine having to pay for an entirely new roof by yourself because of some unexpected storm damage! That would surely burn a deeper hole in your pocket than any potential premium hike.

So while thinking about future premiums is important, don’t forget to weigh it against possible immediate out-of-pocket expenses too. After all, isn’t insurance about helping us manage unexpected financial burdens?

Assessing the Likelihood of Claim Acceptance

Before jumping in, let’s consider one crucial element – the likelihood of your insurance claim being accepted.

No two claims are the same, and insurance companies evaluate each on its merits.

Your home’s age, maintenance history, and even location can all play a big part in whether your claim is approved or not.

While it may seem like a roll of the dice, you can improve your odds by understanding what insurers look for when assessing roof damage claims.

The main thing to understand is that insurers typically cover damages caused by ‘acts of God’—think hurricanes, tornadoes, or hailstorms—and sudden accidental incidents like a tree falling on your house.

If they determine that neglect or lack of maintenance led to the damage though, it could be game over for your claim.

Regular roof inspections and maintenance work are key to avoiding this pitfall!

So before you file that claim, take stock: was this an unforeseen disaster? Or could you have prevented it with some TLC?

The answer might save you from filing an unsuccessful claim and facing possible premium hikes down the line.

Alternatives to Insurance Claims

Having taken the time to consider whether your insurance company will give your claim the green light, it’s also worthwhile exploring different avenues.

After all, filing an insurance claim isn’t the only route you can take when dealing with roof damage.

Don’t immediately assume that submitting a claim is your best option. There are alternatives out there that could save you both time and money in the long run.

For instance, if the damage is minor and repairable at a cost lower than your deductible, then it might be more cost-effective to foot the bill yourself rather than going through your insurer. Or perhaps a local roofing contractor might offer financing options that make repairs more manageable without impacting your insurance premium.

Not to mention, taking preventative measures such as regular roof maintenance can also ward off significant damages from occurring in the first place. It’s like they always say — prevention is better than cure!

So weigh up all these possibilities before deciding how best to tackle your roof damage dilemma.

Making an Informed Decision

Navigating the maze of insurance claims and roof repairs can often feel overwhelming, but by considering all your options and understanding the potential implications of each choice, you’re well on your way to making an informed decision that best suits your situation. It’s like piecing together a puzzle; it might be tricky at first glance but once you start fitting together the pieces, everything becomes clearer.

Be sure to weigh out pros and cons, consider your unique circumstances such as the severity of damage, deductible amount, or even previous claim history. Remember that nobody knows what’s best for you better than yourself.

Reaching out to professionals for guidance is also an excellent move. A trustworthy roofing contractor could give you unbiased advice about whether filing a claim is worth it in your case. Your insurer could provide insights into how a claim might impact future premiums or coverage eligibility. Remember that this journey isn’t one you need to traverse alone; resources are available to help guide you along this path towards resolution.

You’ve got this! Making an informed decision may seem daunting now, but once done, it’ll be a weight off your shoulders knowing that whatever happens next is aligned with your best interests.re